Santa Clara County March Real Estate Market Report

The Spring Market Begins

March 2019 Report

Spring 2018 was one of the hottest markets in Santa Clara County and around the Bay Area over the last 2 decades. The market began to appreciably cool in summer and autumn – demand, sales and appreciation rates significantly dropping, while supply and price reductions jumped. Then the mid-winter doldrums took hold.

Since the recovery began in 2012, spring has typically been the most active season of the year, and the period during which appreciation gains have been the largest. The spring 2019 market is just getting started amid a diverse set of economic indicators. Financial markets have, so far, recovered in 2019, interest rates have dropped, and big local IPOs loom. We will know much more soon.

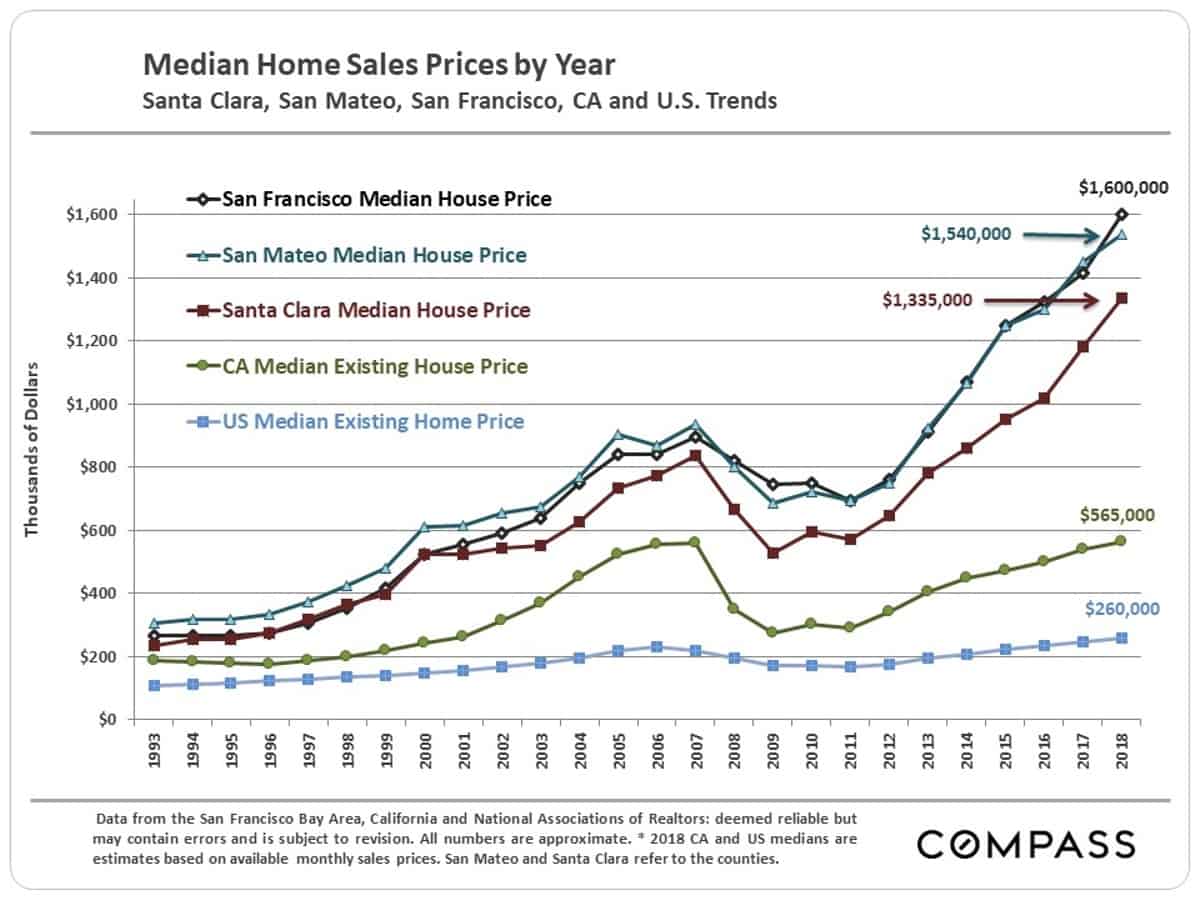

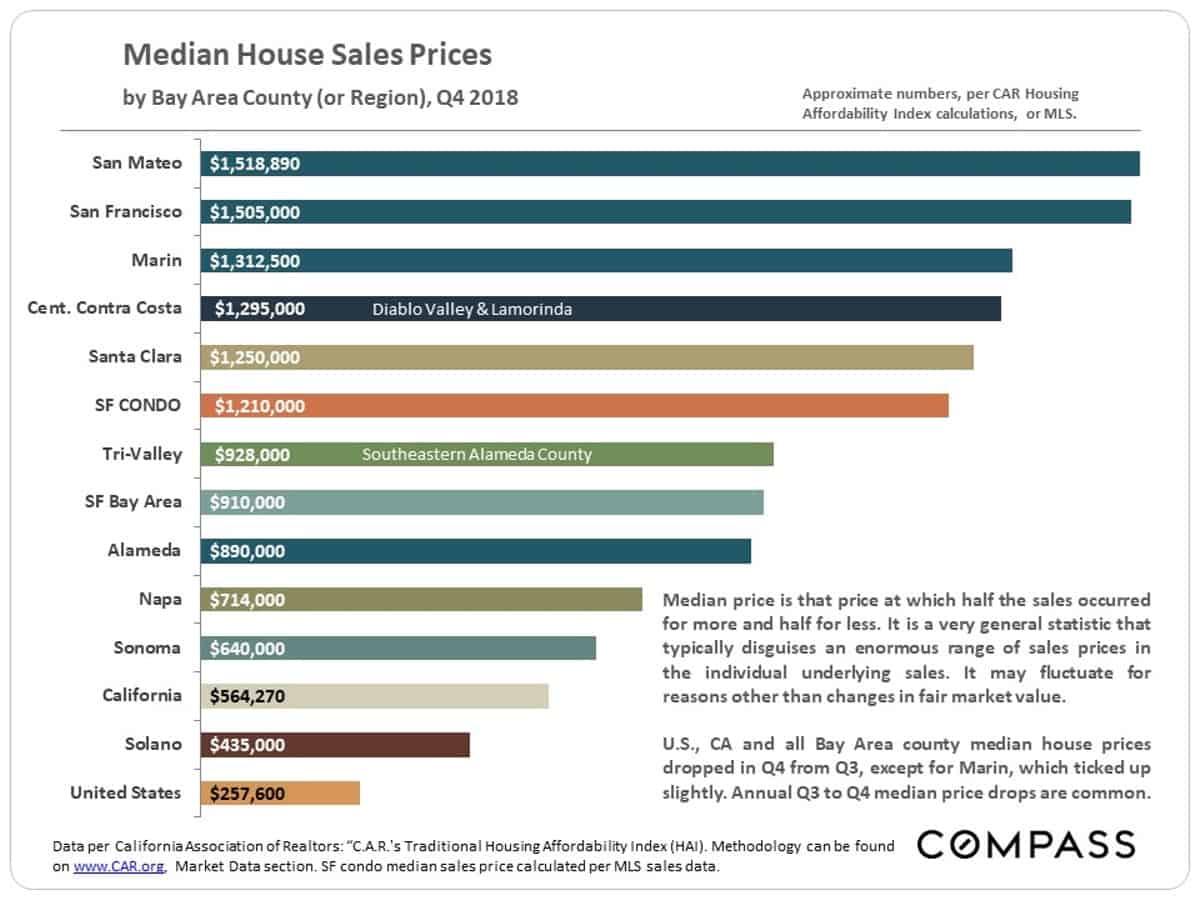

Median Sales Price Trends

Long-Term, Annual Trends in Median Prices

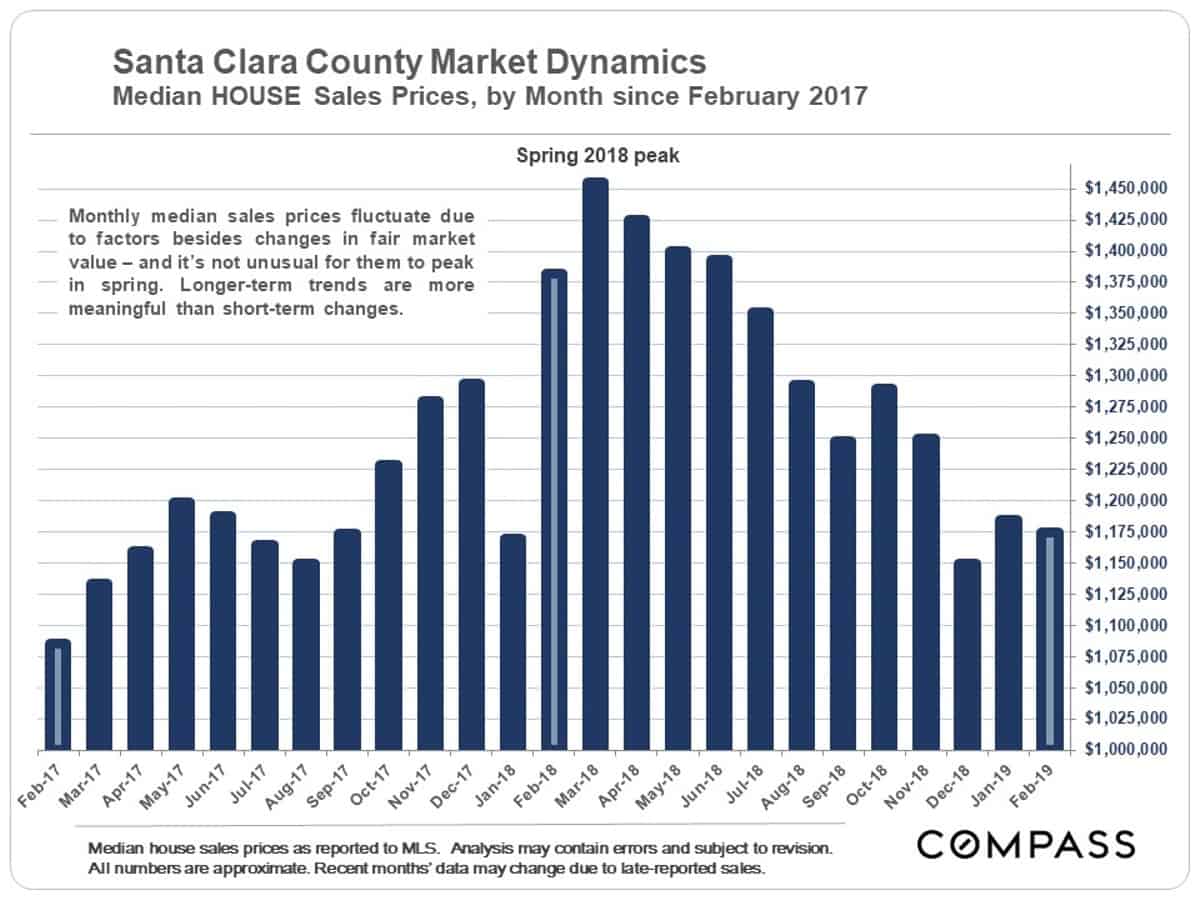

Short-Term, Monthly Median House Price Changes

Year over year, the February monthly median house sales price saw a big drop over February 2018, and from the spring 2018 peak. But February is a very low-sales-volume month, and what is much more important is what happens to the median house sales price over the next 3-4 months – a period during which median prices often peak for the year.

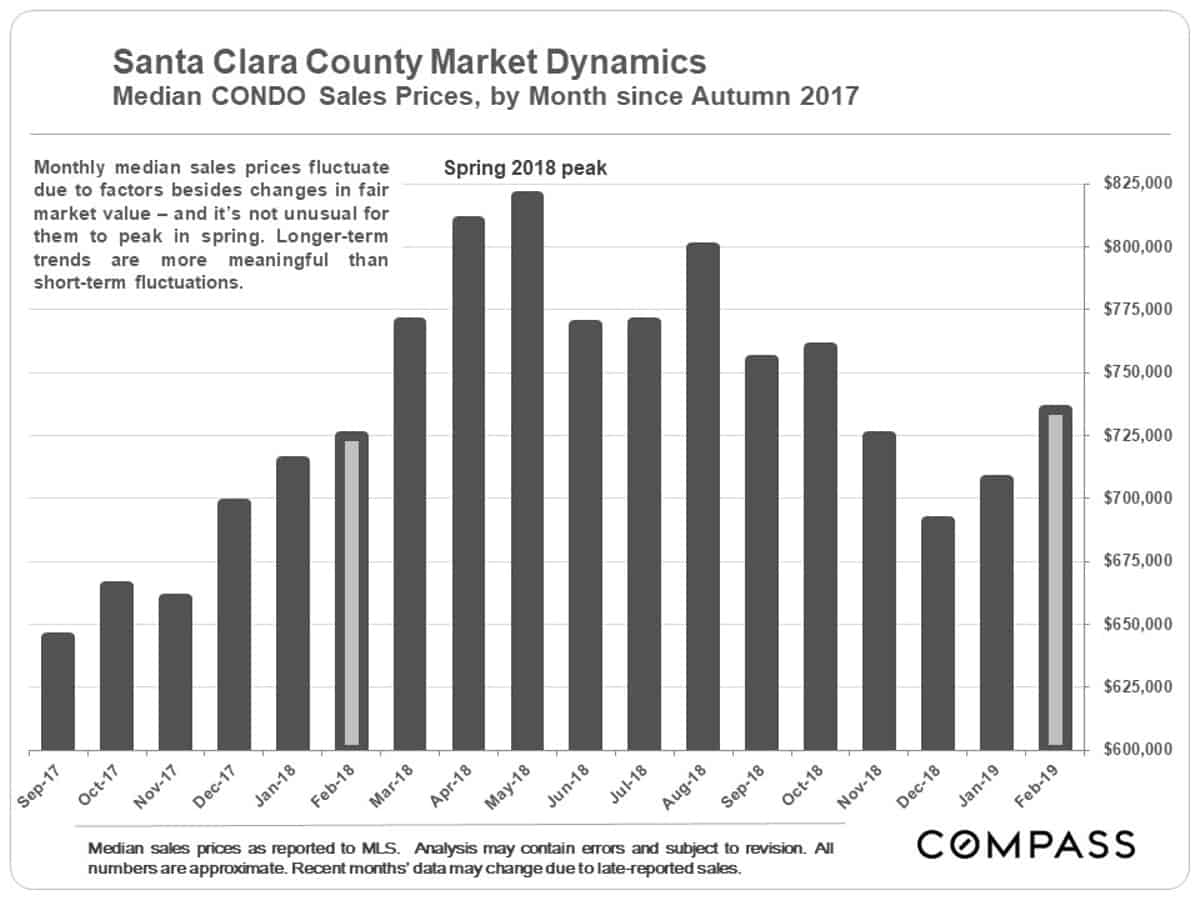

Median Condo Sales Prices by Month

The monthly median condo sales price actually ticked up a bit in February, year over year – but, again, this is based on very low sales volume.

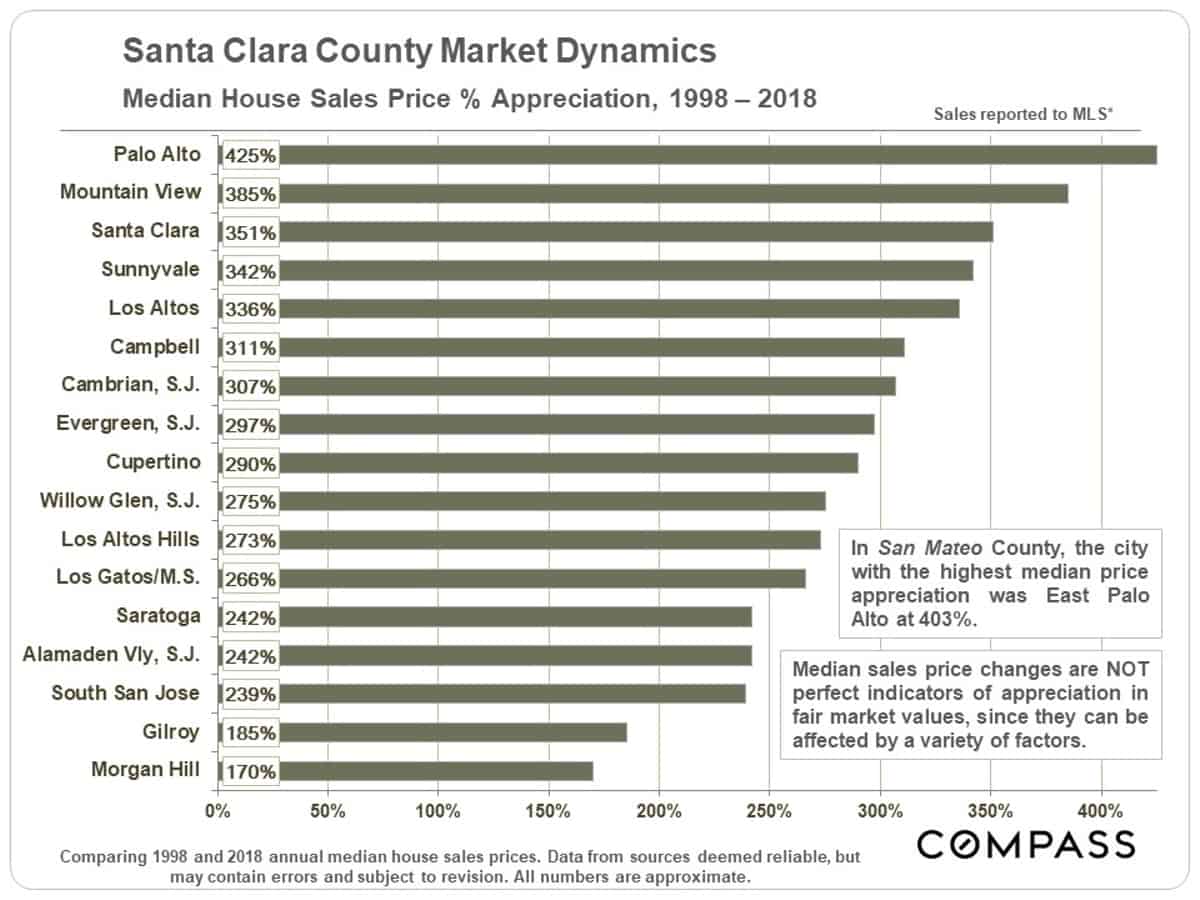

Median Home Price Appreciation

since 1998, by City

Markets appreciate due to a wide variety of local and macro-economic reasons: economic cycles, industry booms, inflation, consumer confidence, interest rates, employment, gentrification, new construction, comparative affordability (to other nearby markets), population growth, buyers’ median age, commuting, fashion, and so forth. The combination of factors affecting any particular area is often specific to that market.

Around the Bay Area, more expensive homes have generally appreciated less than more affordable homes, especially over the last 3-4 years, but the picture in Silicon Valley is more complicated. For example, Palo Alto, which is certainly not considered one of the more affordable cities, saw the highest 20-year appreciation rate in the county. These percentages should be considered very approximate.

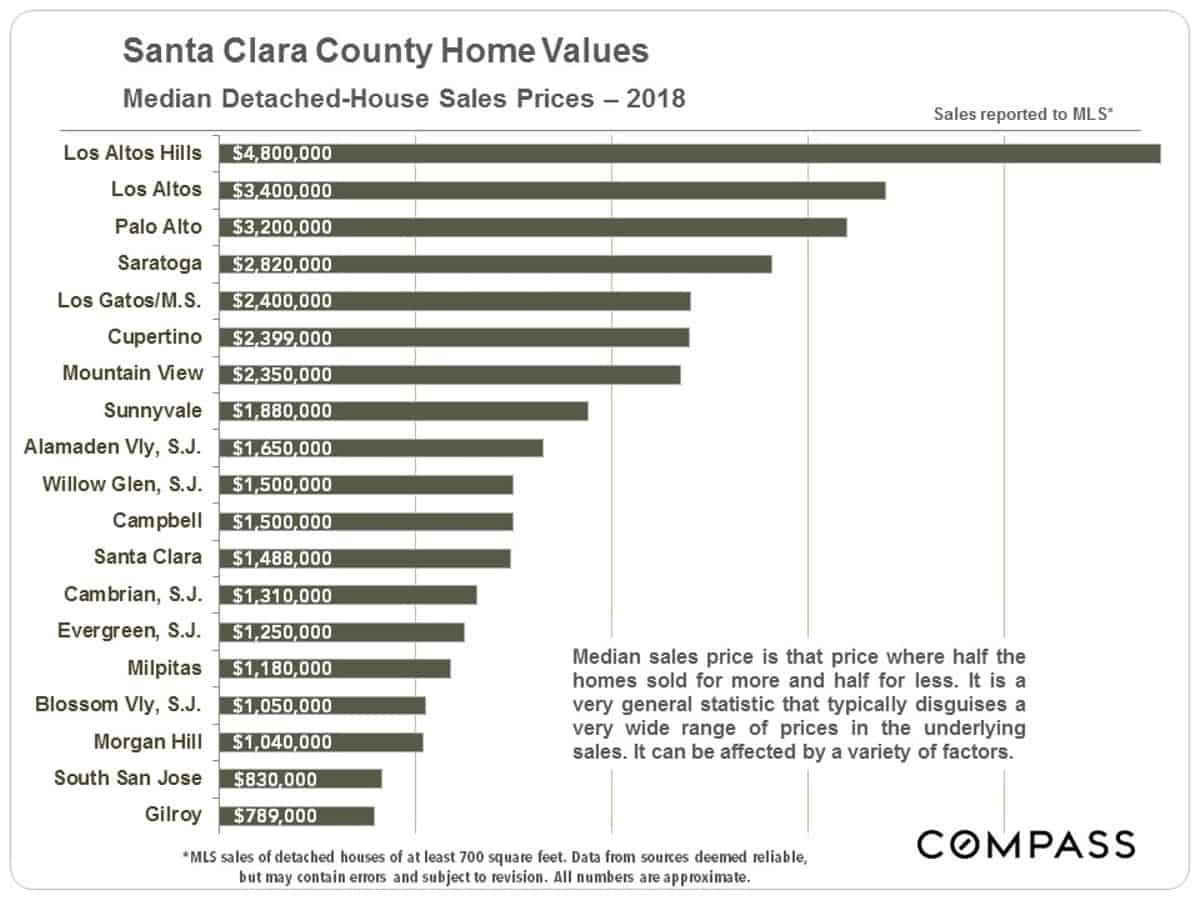

For further context on the appreciation chart above, below is a chart from last month’s report with 2018 median house sales prices.

What’s for Sale in Santa Clara

Inventory Levels in January-February

Year-over-Year Comparisons

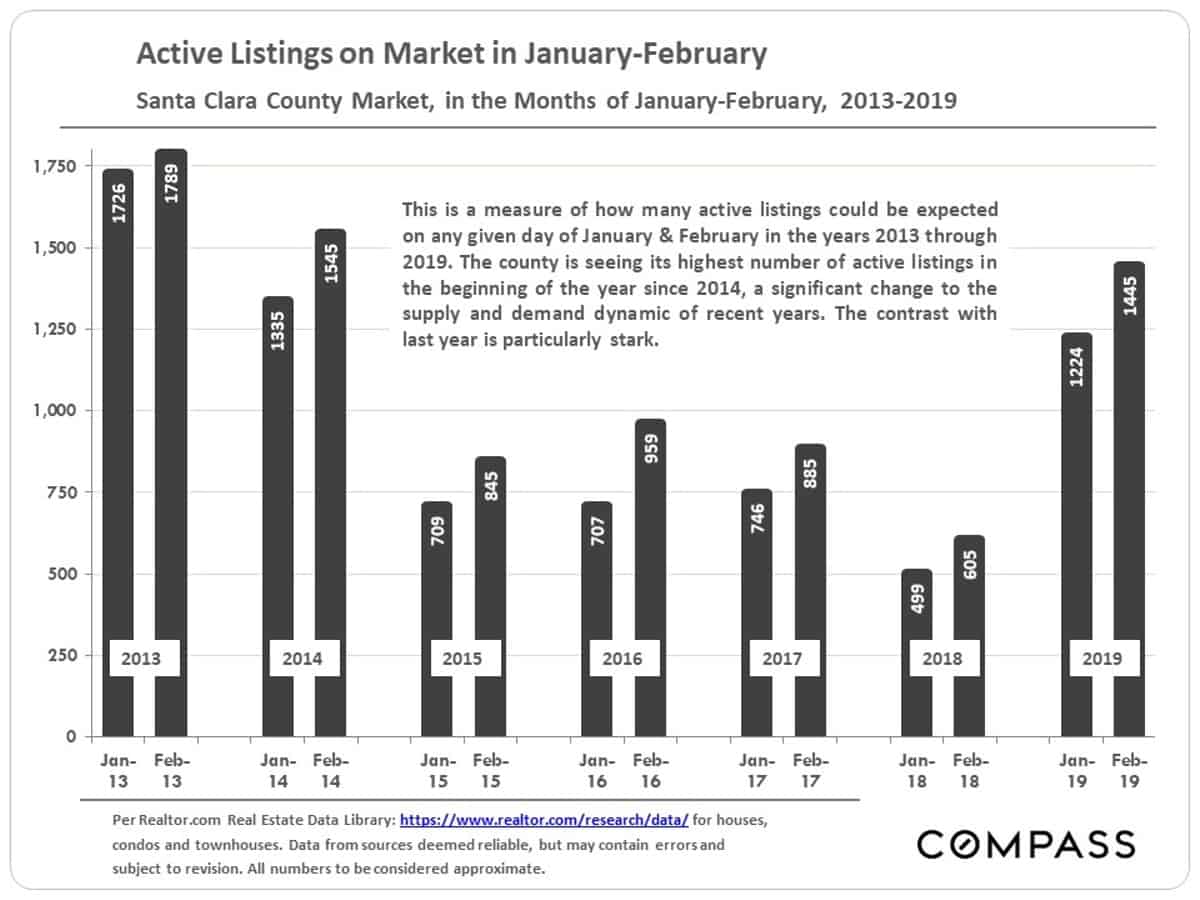

January-February inventory levels are far above those seen in the same months of the past 4 years. The level in early 2018, in particular, was crazy low, which helped fuel the spring 2018 jump in median sales prices.

Home Listings on Market

by Price Segment, 3/1/19

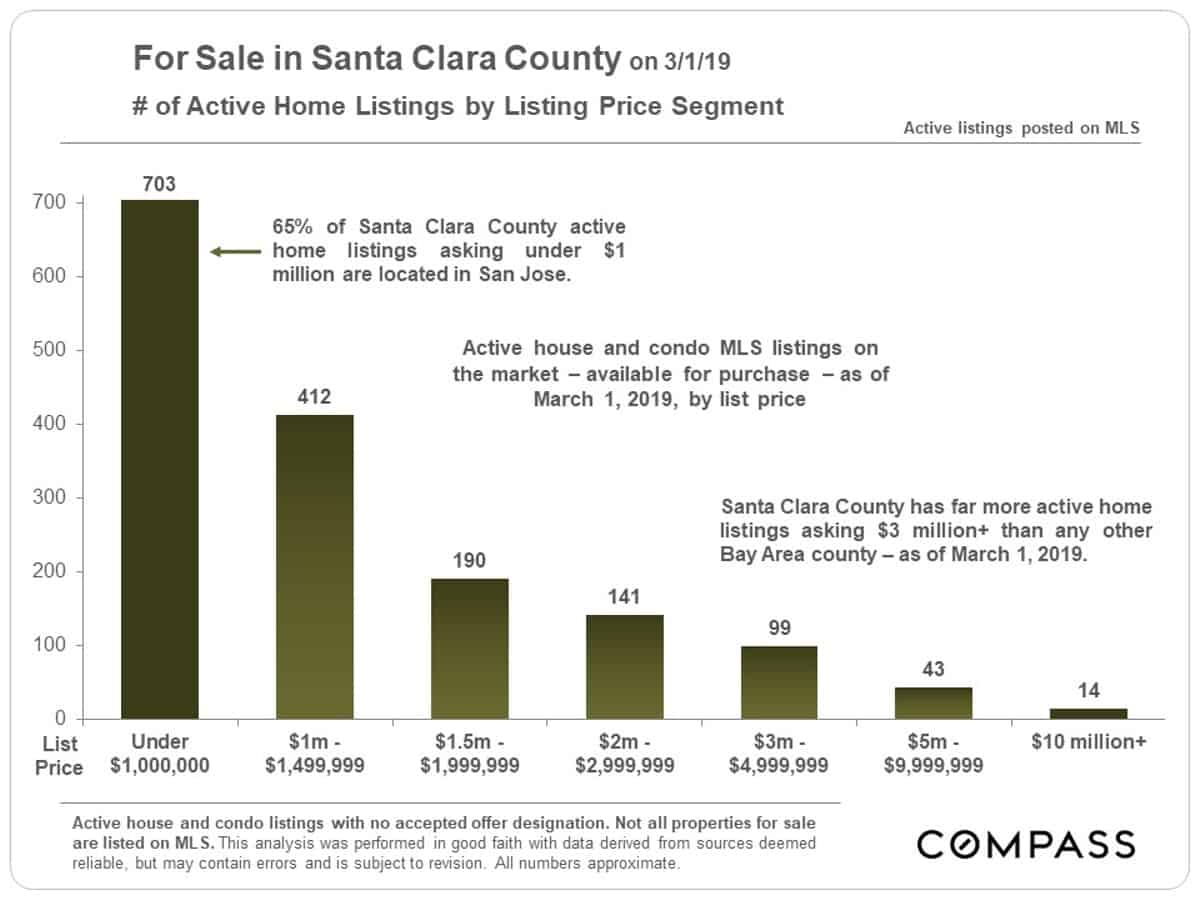

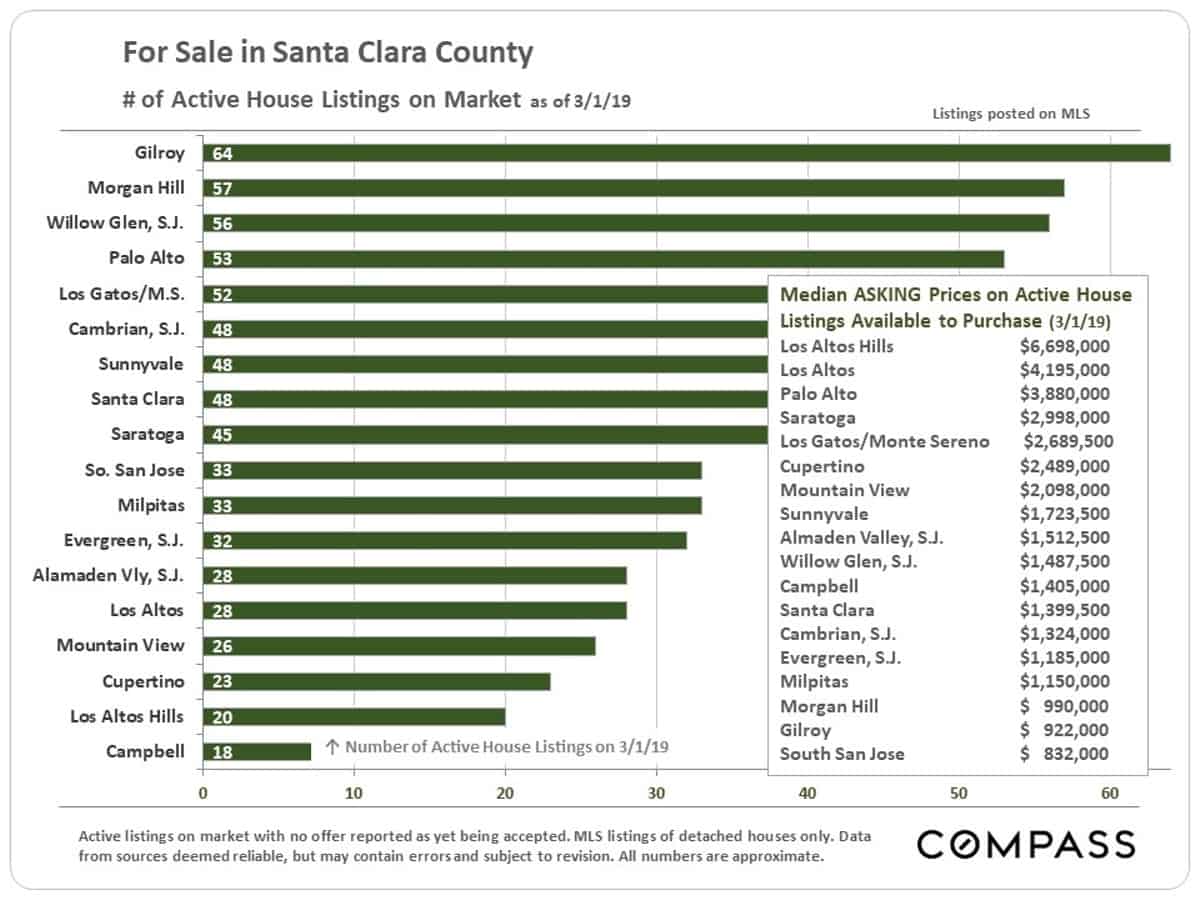

The number of active listings fluctuates daily, and the numbers below are rapidly increasing as more new listings come on market. These next 2 charts are snapshots of active listings on March 1st.

House Listings on Market by City

with Median LIST Prices, 3/1/19

The supply of listings available to purchase varies widely between cities, which can be a simple reflection of market size and/or an indicator of supply and demand dynamics. If median LIST prices (below) are well above median SALES prices (charted earlier in this report), it is typically a sign that the balance in listings for sale is disproportionately weighted towards higher priced properties, where demand is softer – and/or a sign of systemic overpricing beyond what buyers now consider fair market value.

Market Seasonality

New Listings Coming on Market

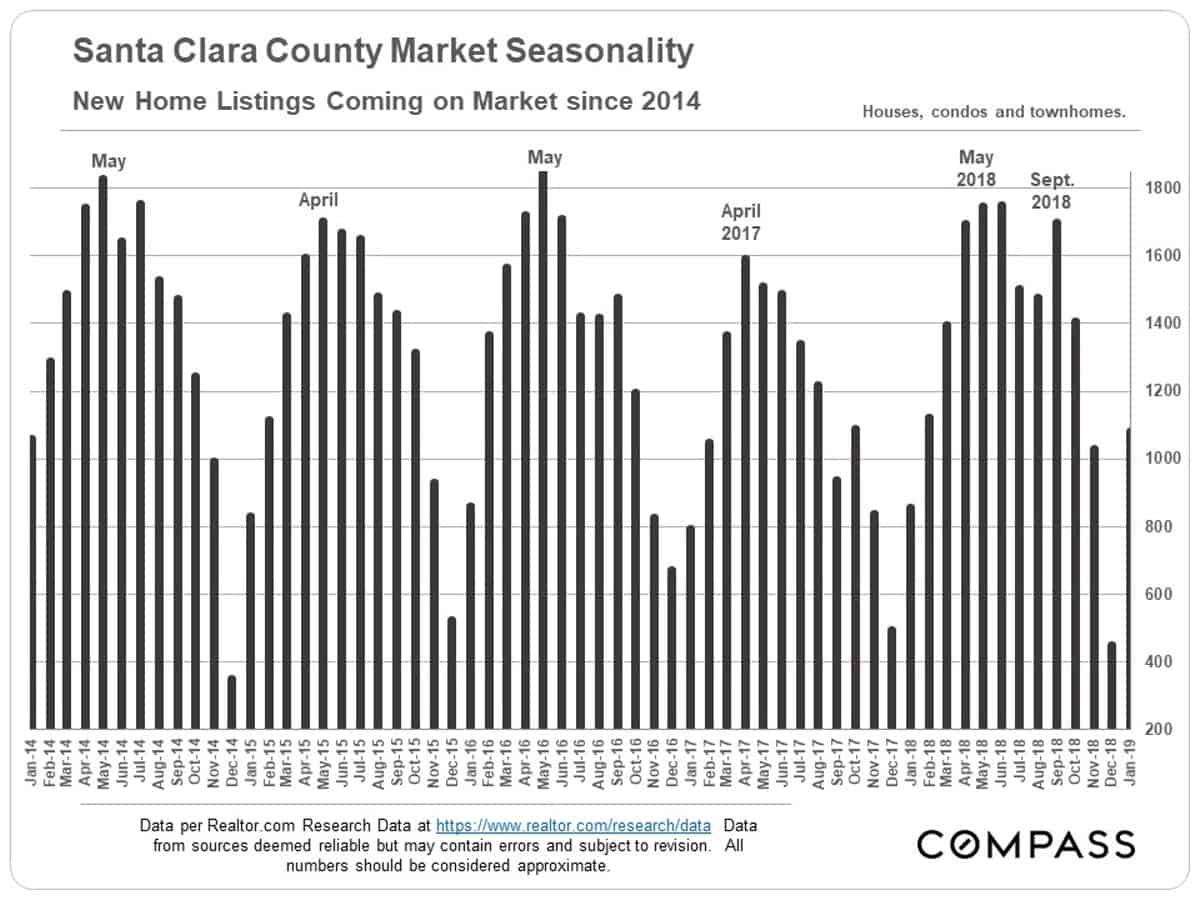

New inventory usually starts pouring into the market right now, in early spring, to fuel what is usually the biggest selling season of the year.

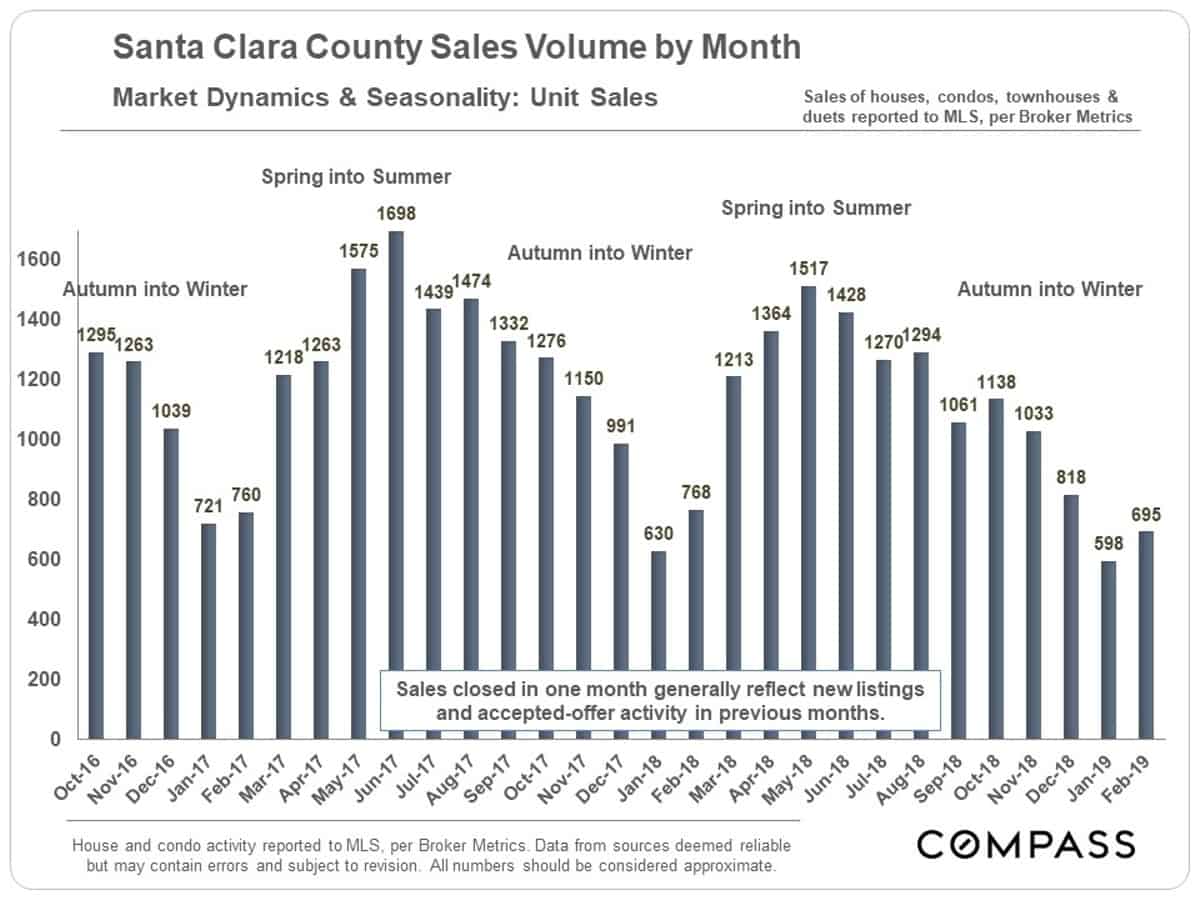

Number of Home Sales by Month

While the number of listings has been increasing, the number of sales has been declining. But a much more meaningful indicator will be what occurs in spring sales volume – beginning in March when sales usually start to soar.

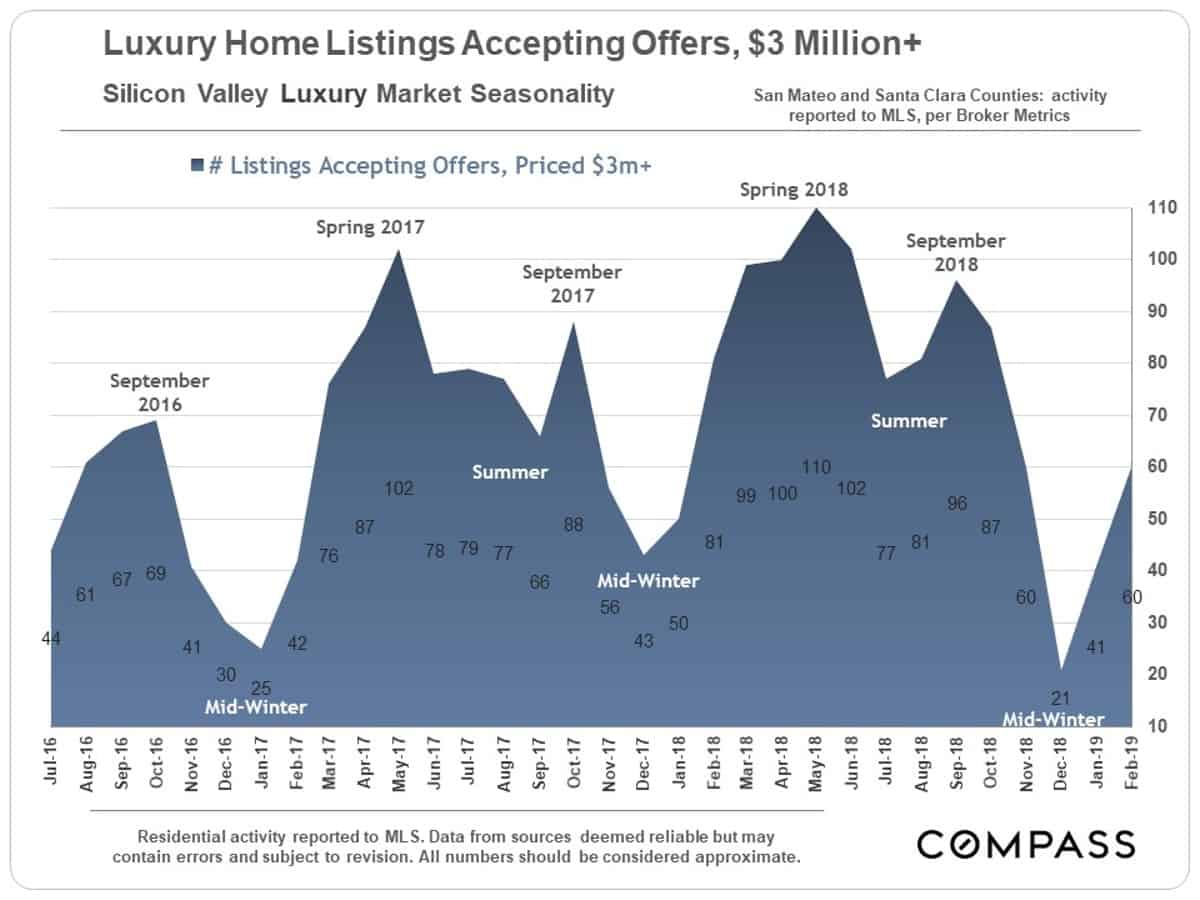

Luxury Home Listings Accepting Offers

by Month

If anything, the luxury home segment is even more fiercely seasonal than the general market.

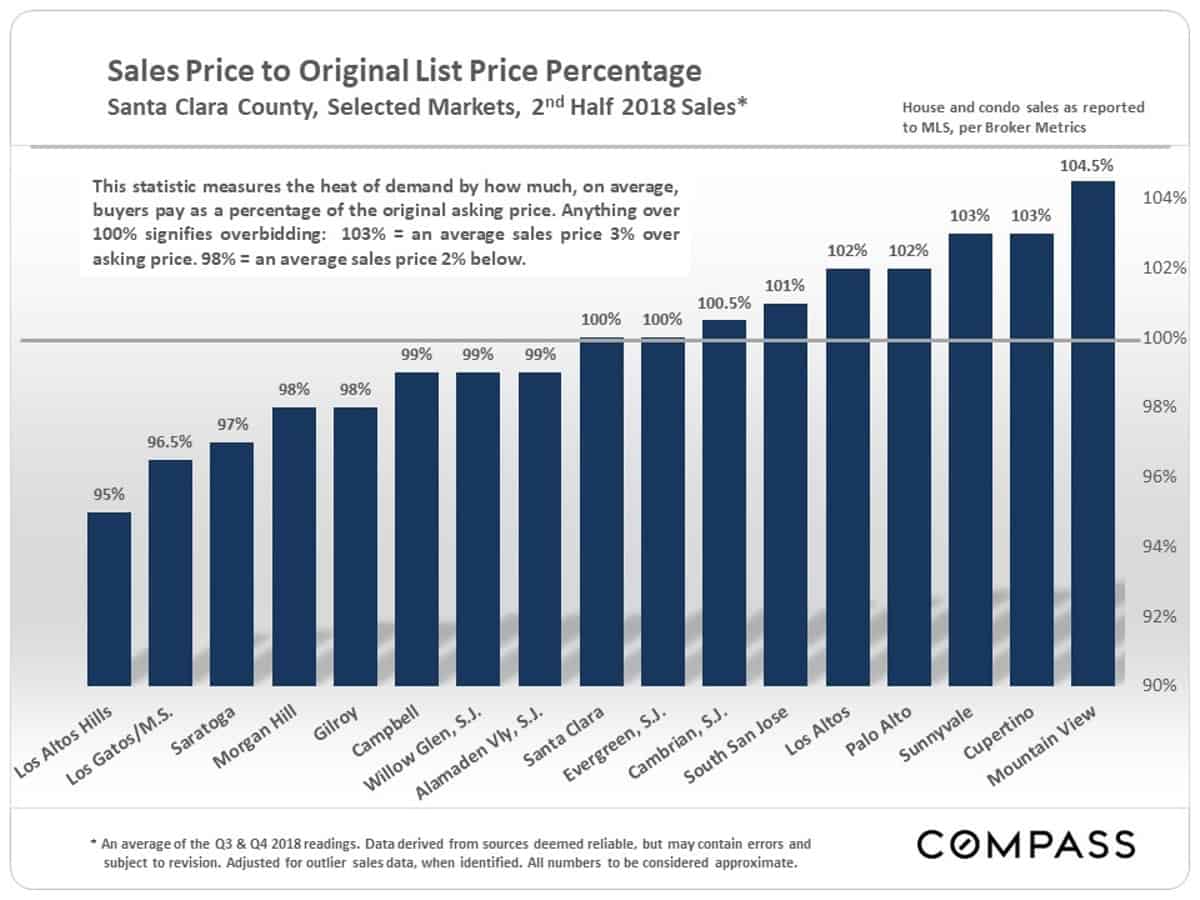

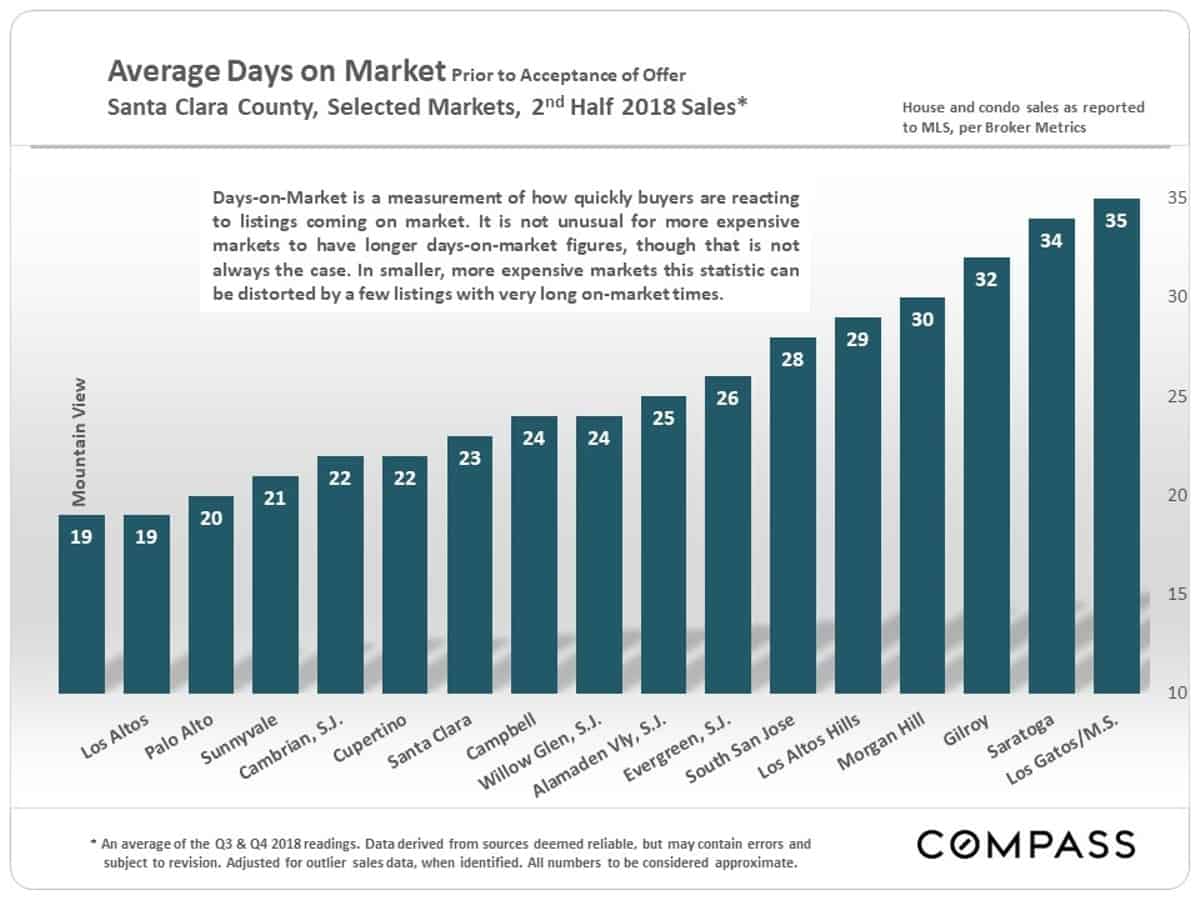

Market Statistics by City

There is a wide variety of factors in play when comparing the respective market heat prevailing in different cities – one of them is certainly proximity to the headquarters of our high-tech giants; comparative affordability is often another big factor.

Sales Price to Original List Price %

Average Days on Market

by City

Comparing Bay Area Markets

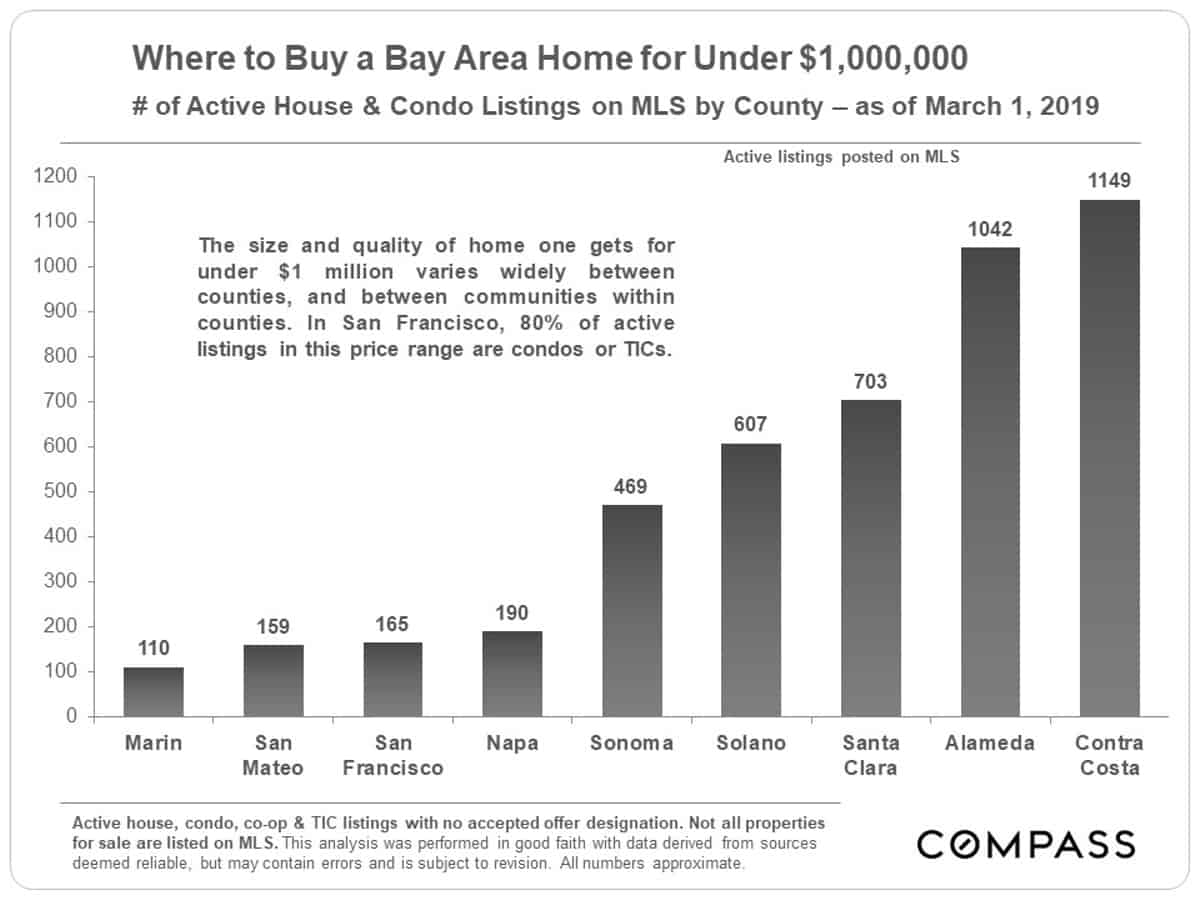

Where to Buy a Home for under $1 Million

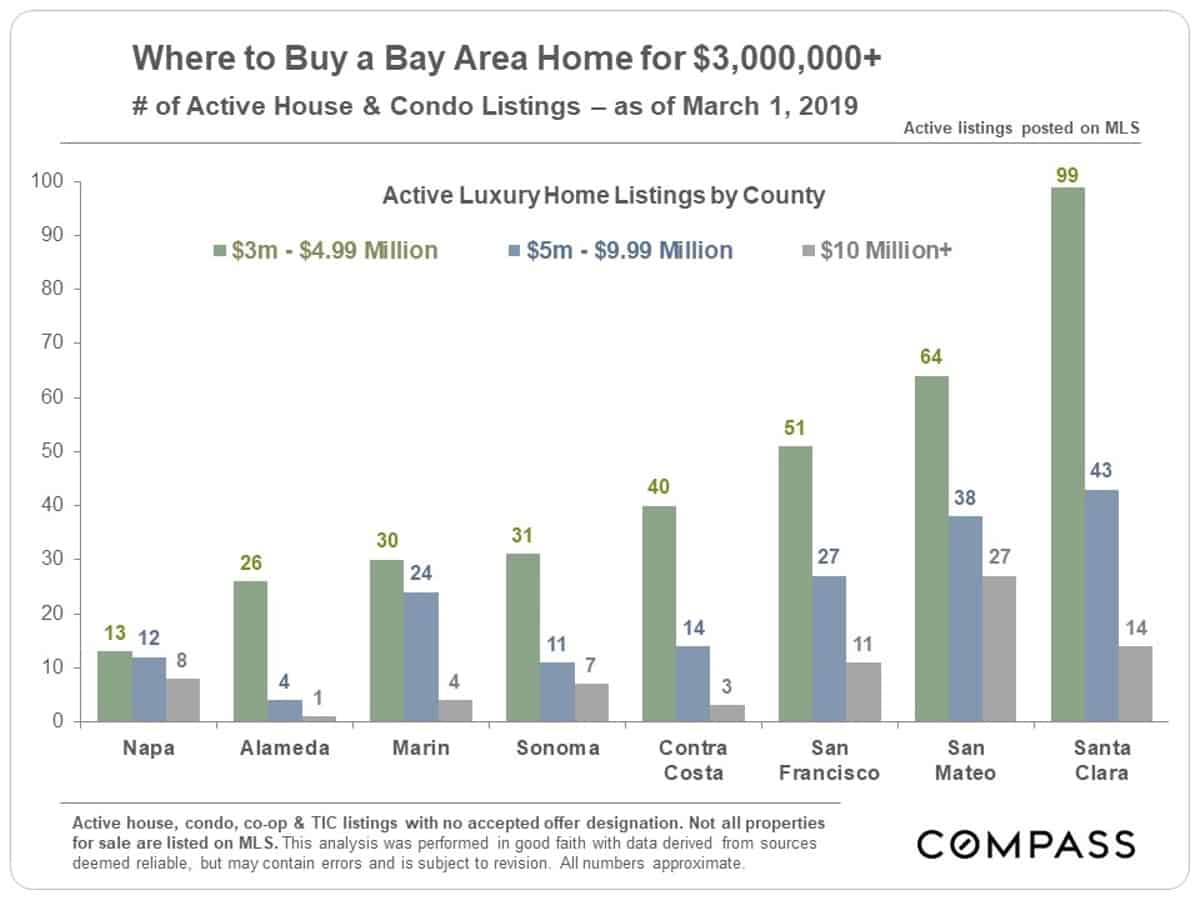

Where to Buy a Luxury Home

Santa Clara County has the largest market for homes priced $3 million and above in the state, though San Mateo takes the lead for homes of $10 million+. San Francisco has by far the largest luxury condo market.

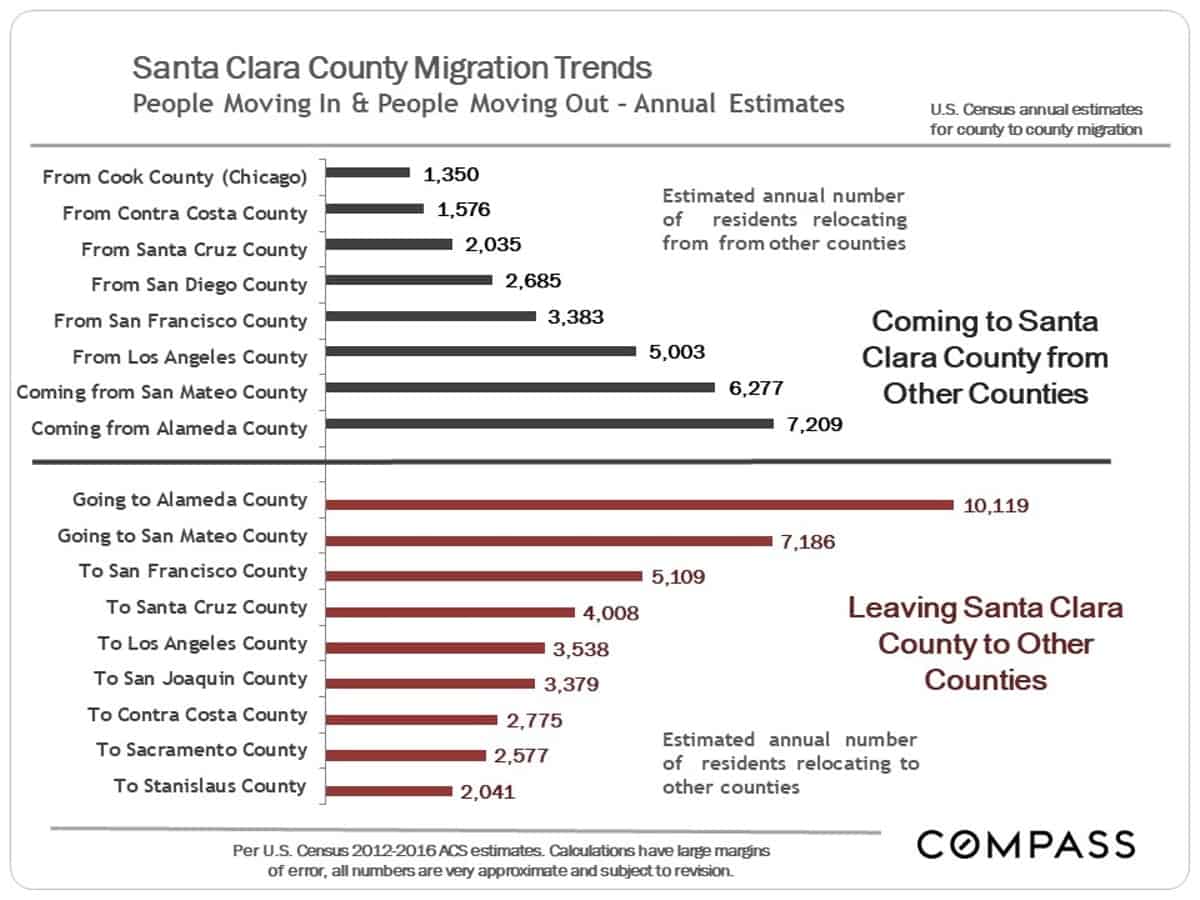

County to County Migration

People move to Santa Clara County from all over the country and the world, and people leave to move to a vast number of locations – for many differing reasons. This analysis looks at those counties with the greatest number of people moving to and from Santa Clara. In many cases, there is a large exchange between 2 counties, with residents going in both directions. Often, but not always, the outward flow is greater to counties with more affordable home prices, but there are many factors – such as schools, employment, commuting times and other quality of life issues – at play.

Demographics Snapshot

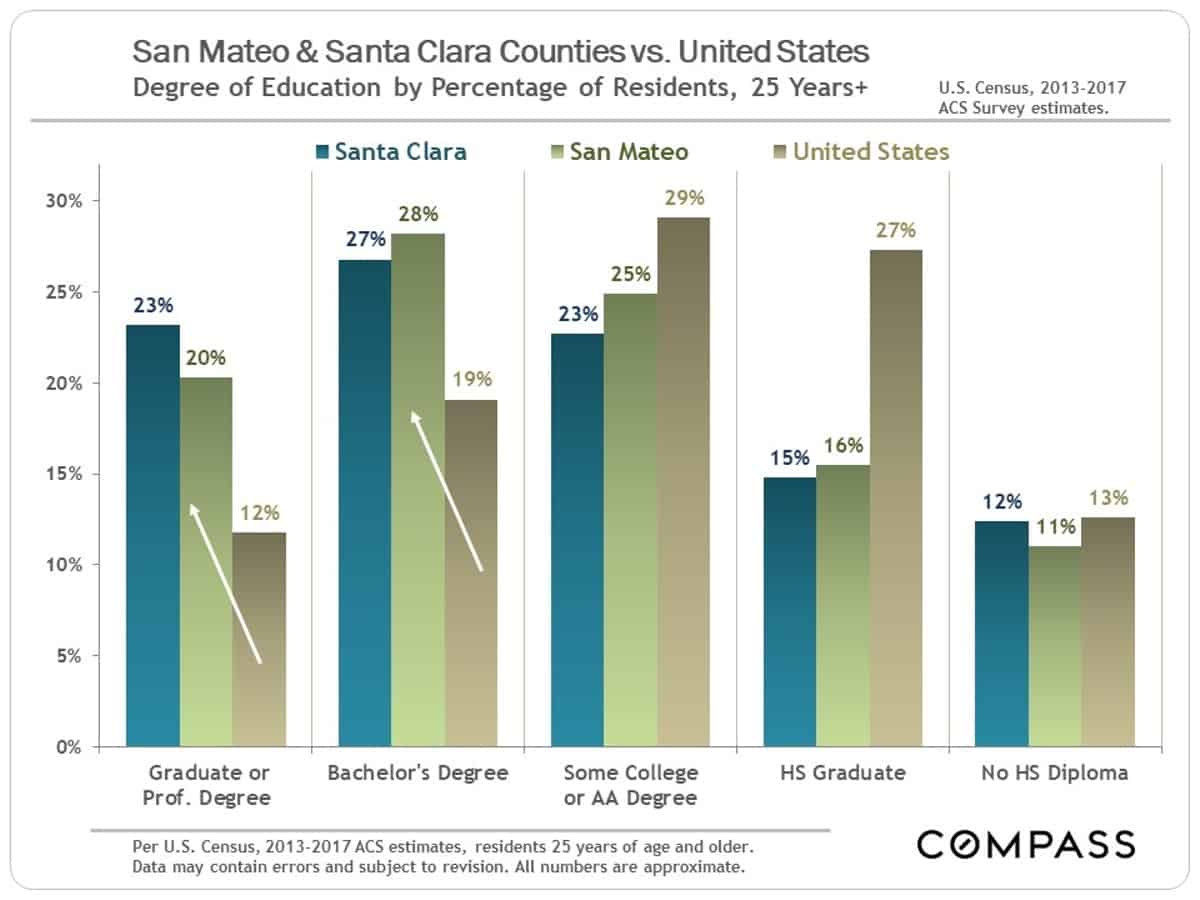

Educational Attainment

Silicon Valley vs. U.S.

Unsurprisingly, Santa Clara and San Mateo are among the most highly educated counties in the country.

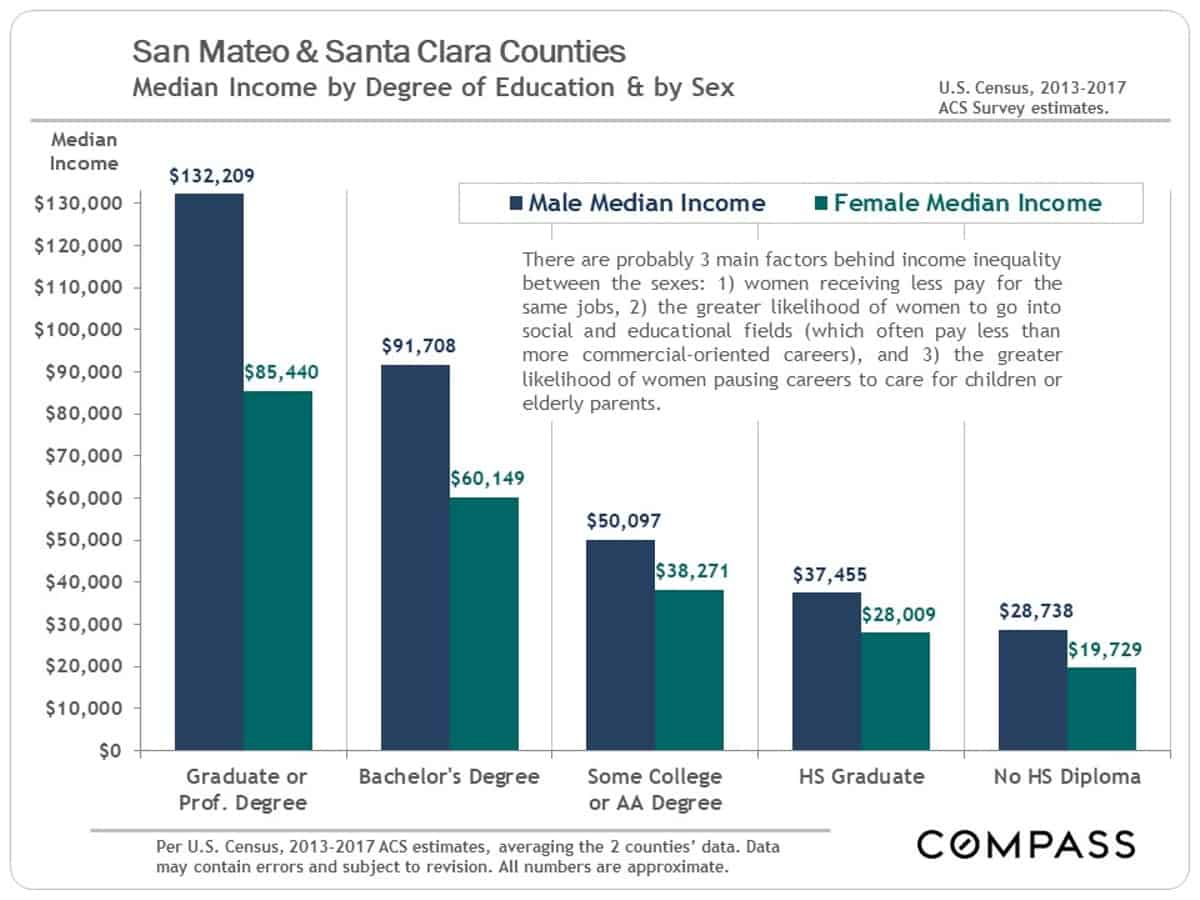

Education & Income

Disparity between the Sexes

An indicator of the income-generating value of education, along with an unhappy indicator of where progress remains to be made in income equality. (As an aside, real estate is certainly one of the first professions that saw income equality established between the sexes: Women have been holding their own and, indeed, often dominating rankings of top Bay Area agents for many decades.)

The statistics in this report are very general and approximate indicators based upon listing and sales data pertaining to assortments, of varying size, of relatively unique homes across a broad spectrum of locations and qualities. How these statistics apply to the current value, appreciation trend, and prevailing market conditions of any particular property is unknown without a specific comparative market analysis.